tax avoidance vs tax evasion australia

Tax evasion is a serious offense and those found guilty can be fined andor jailed. Tax Avoidance vs.

Pdf Tax Avoidance Tax Evasion And Tax Flight Do Legal Differences Matter

Businesses get into trouble with the IRS when they intentionally evade taxes.

. While you get reduced taxes with tax avoidance tax evasion can result in fines penalties imprisonment or. II THE AUSTRALIAN APPROACH TO TAX AVOIDANCE AND TAX EVASION It is generally acknowledged that tax evasion constitutes an act outside the law whereas tax avoidance is considered an act within the law. Difference Between Tax Evasion and Tax Avoidance.

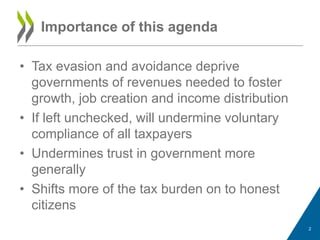

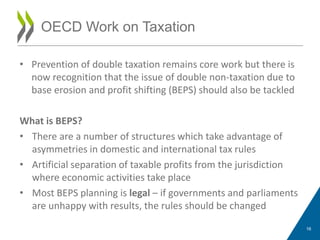

Australia is leading the global fight against multinational tax avoidance and is cracking-down on taxpayer tax evasion with a number of reforms announced as part of the 2016-17 Budget. The difference between tax avoidance and tax evasion boils down to the element of concealing. Basically tax avoidance is legal while tax evasion is not.

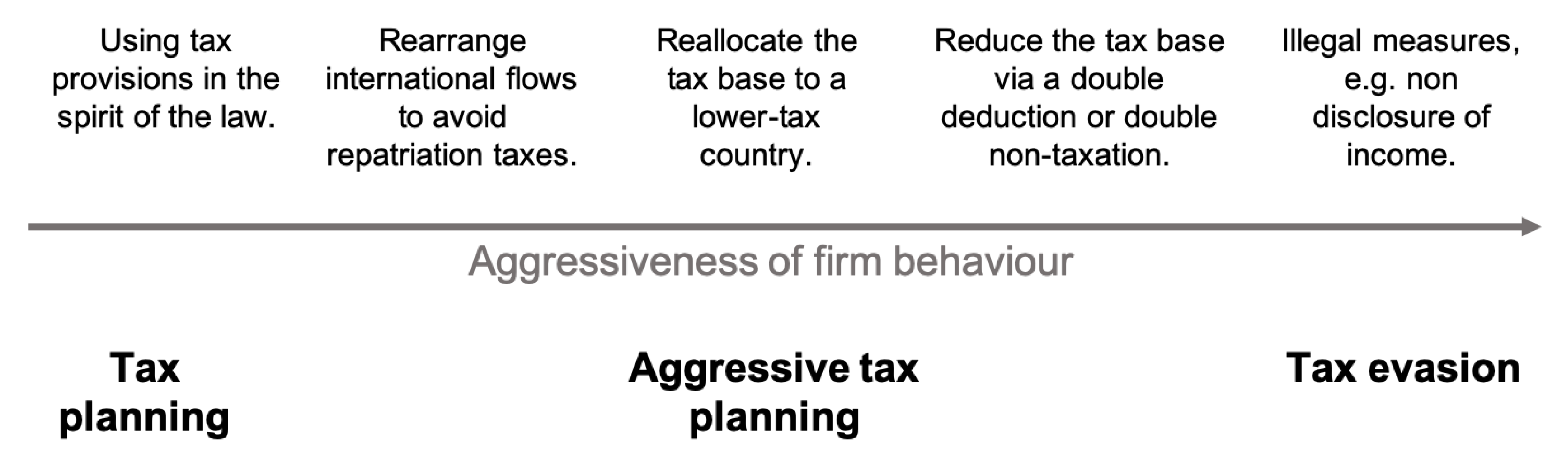

This basic principle of taxation law is supported by the definitions of tax avoidance and tax evasion. Tax avoidance vs tax evasion examples. A further sub-set of tax aggressiveness is tax avoidance which refers to tax planning activities that have a low level of.

Increasingly complex business relationships and. Structuring your affairs in order to pay less tax is legal. Tax evasion means concealing income or information from tax authorities and its illegal.

However tax evasion ie. Formed in 2016 it enhances and extends our existing activities to eradicate illegal and fraudulent tax arrangements. Or both and be responsible for prosecution costs.

The following are the major differences. Reporting taxes that are not allowed legally. While they may sound similar tax avoidance is the legal practice of minimizing tax liability within the framework of the tax code in contrast to tax evasion which is the deliberate failure to pay taxes or comply with tax law.

Underground economyMoney-making activities that people dont report to the government including both illegal and legal activities. Reducing tax liability is a top priority for every corporate tax department. Tax evasion and multinational tax avoidance Treasurygovau.

The Government of any country offers areas and multiple options to the public and entities in reducing and encouraging investments that serve as tax-saving instruments. Tax avoidance includes taking advantage of tax deductions and using tax shelters to. Tax Evasion VS Tax Avoidance.

The Tax Avoidance Taskforce ensures multinational enterprises large public and private businesses and associated individuals pay the right amount of tax in Australia. In Australia tax fraud is criminalized by both the Federal Government and State Governments. The Fine and Hazy Line between Tax Avoidance and Tax Evasion The difference between tax avoidance and tax evasion is the thickness of a prison wall - Denis Healey.

Imprisoned for up to five years. Rich individuals and large trans-national companies such as Google and Apple pay very little tax including here in Australia. Tax avoidance is immoral that tends to bend the law without causing any damage to it.

Keeping in mind the contradiction between the heading of this article and the quotation above I wish to draw your attention to an illustration. In tax avoidance you structure your affairs to pay the least possible amount of tax due. An unlawful act done to avoid tax payment is known as tax evasion.

A taxpayer charged with tax evasion could be convicted of a felony and be. Tax Evasion What every tax director needs to know about criminal tax fraud. While tax avoidance and tax evasion are both centred around avoiding paying taxes they are very different.

Tax planning and Tax avoidance is legal whereas Tax evasion is illegal. Tax fraud also commonly known as tax evasion is the illegal abuse of the taxation system for financial benefit. An unlawful act done to avoid tax payment is known as Tax Evasion.

Acting in an illegal manner in order to pay less tax is a criminal offense. Whilst tax evasion is illegal tax avoidance is not. To summarise tax avoidance is a legal and legitimate strategy while tax evasion is illegal and results in harsh punishments.

There are lawful ways to reduce your tax and. The taskforce bolsters our pre-existing efforts in tackling tax avoidance. But your business can avoid paying taxes and your tax preparer can help you do that.

In tax evasion you hide or lie about your income and assets altogether. Tax planning is the method of saving tax However tax avoidance is dodging of tax. Tax evasion is illegal and objectionable.

Tax evasion is an act of concealing tax. Tax avoidance means legally reducing your taxable income. Fined up to 100000 or 500000 for a corporation.

Many different Federal and State offences fall under the. Tax planning is moral. There are a number of penalties that authorities could apply such as a failure to file penalty or an underpayment penalty.

Tax Evasion is a known fraud of not paying the liable taxes while Tax Avoidance is a well-structured plan to identify methods to reduce the outflow towards tax payments. Tax Evasion refers to the adoption of illegal methods for reducing liability of payment of taxes such as manipulation of business accounts understating of incomes or overstating of expenses etc whereas Tax Avoidance is the legal way to reduce the tax liability by following the methods that are allowed in the income tax laws of. And not reporting income.

Unlike tax evasion which is illegal and objectionable both according to law and morality. By George Abney and Paul Monnin December 3 2018. Tax fraud is a serious crime and carries a maximum penalty of up to 10 years imprisonment.

Their favorite method of dodging the tax bill is by using. Tax evasionThe failure to pay or a deliberate underpayment of taxes. Tax avoidance refers to hedging of tax but tax evasion implies the suppression of tax.

Tax Avoidance Vs Tax Evasion Infographic Fincor Tax evasion means concealing income or information from tax authorities and its illegal. Tax evasion vs tax avoidance. Tax evasion is the illegal practice of not paying taxes by not paying the taxes owed.

But that priority must be tempered by tax compliance obligations. Tax avoidanceAn action taken to lessen tax liability and maximize after-tax income. Tax avoidance is immoral.

In the 2001 movie Blow George.

Ini Beda Tax Planning Tax Avoidance Dan Tax Evasion

Pdf Taxpayers Subjective Concepts Of Taxes Tax Evasion And Tax Avoidance

Tax Evasion And Tax Avoidance Parliamentary Days 2014

Games Free Full Text Gaming The System An Investigation Of Small Business Owners Attitudes To Tax Avoidance Tax Planning And Tax Evasion Html

Ini Beda Tax Planning Tax Avoidance Dan Tax Evasion

Tax Avoidance Png Images Pngwing

Explainer The Difference Between Tax Avoidance And Evasion

Tax Avoidance Secret Mining Deals And Financial Transfers Are Depriving Africa Of The Benefits Of Its Resources Boom Ex Un Chief Kofi A Art Google Africa Art

Tax Evasion Is Unlawful Tax Avoidance Is Legal To Arrange Your Affairs In A Such A Way So As To Minimize Tax Is Quite Legal Tax Avoidance Www Trustdeedr

Legislating Against Tax Avoidance Ibfd

Don T Let The Myths Of Online Education Stop You From Achieving Your Dreams Tax Planning Business Planning How To Plan

Tax Avoidance Png Images Pngwing

Pdf Tax Avoidance Tax Evasion And Tax Flight Do Legal Differences Matter

Tax Avoidance Vs Tax Evasion Infographic Fincor

Tax Evasion And Tax Avoidance Parliamentary Days 2014

Pdf Tax Planning Avoidance And Evasion In Australia 1970 2010 The Regulatory Responses And Taxpayer Compliance

Explainer What S The Difference Between Tax Avoidance And Evasion

Requalification Of Tax Avoidance Into Tax Evasion

Australia Continues To Host Significant Quantities Of Illicit Funds From Outside The Country And Is Not Money Laundering Dollar Money Anti Money Laundering Law