vermont income tax rate 2021

If you make 70000 a year living in the region of Vermont USA you will be taxed 12902. Vermont Income Tax Calculator 2021.

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

W-4VT Employees Withholding Allowance Certificate.

. 189 of home value. Complete Edit or Print Tax Forms Instantly. Your average tax rate is 1198 and your marginal tax rate is.

Vermont School District Codes. Discover Helpful Information and Resources on Taxes From AARP. Our simple process takes less than 15 Minutes.

Grab your tax docs and try our calculator. IN-111 Vermont Income Tax Return. The 2022 state personal income tax brackets.

Ad Access IRS Tax Forms. Vermonts tax system consists of a state personal income tax estate tax state sales tax local property tax local sales taxes and a number of additional excise taxes on. There are a total of eleven states with higher marginal corporate income tax rates then Vermont.

PA-1 Special Power of Attorney. Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower. Marginal Corporate Income Tax Rate.

THE TAX SCHEDULES AND RATES. Vermont Income Tax Rate 2020 - 2021. For fourth year in a row Piscataway Township has a 128 percent lower municipal tax rate.

Start filing your tax return now. Before the official 2022 Vermont income tax rates are released provisional 2022 tax rates are based on Vermonts 2021 income tax brackets. As you can see your Vermont income is taxed at different rates within the given tax brackets.

Tax amount varies by county. Vermont Tax Brackets for Tax Year 2020. Vermont state income tax rate table for the 2020 - 2021 filing season has four income tax brackets with VT tax rates of 335 66.

Vermonts rate schedules are designed to maintain at least 15 years of funding if no additional taxes are paid. Ad Learn More About the Adjustments to Income Tax Brackets in 2022 vs. The Township tax rate had no increase in 2021 2020 and 2019 after having been lowered.

Ad No Upfront Fees To Get Qualified - 100 Contingent On Your Payroll Tax Refund. The median property tax in New Jersey is 657900 per year for a home worth the median value of 34830000. More about the Vermont Tax Rate Schedules Individual Income Tax TY 2021 We last updated the Income Tax Rate Schedules in March 2022 so this is the latest version of Tax Rate Schedules.

Vermont State Personal Income Tax Rates and Thresholds in 2022. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. 2021 Vermont Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator.

Any income over 204000 and 248350 for.

Sales Tax Definition What Is A Sales Tax Tax Edu

More Than 1 In 8 Oklahoma Children Live In A Home Where The Head Of The Household Doesn T Have A High S Counting For Kids Education Issues Health Care Coverage

Headlines For December 15 2021 Headlines St Louis Headline News

Vermont Income Tax Calculator Smartasset

10 States With No Property Tax In 2020 Property Tax Property Investment Property

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

State Income Tax Rates What They Are How They Work Nerdwallet

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

U S Gross Domestic Product Gdp By State 2021 Statista

6190 Trillium Crescent Niagara Falls

How Much Is Netflix Per Month In 2021

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

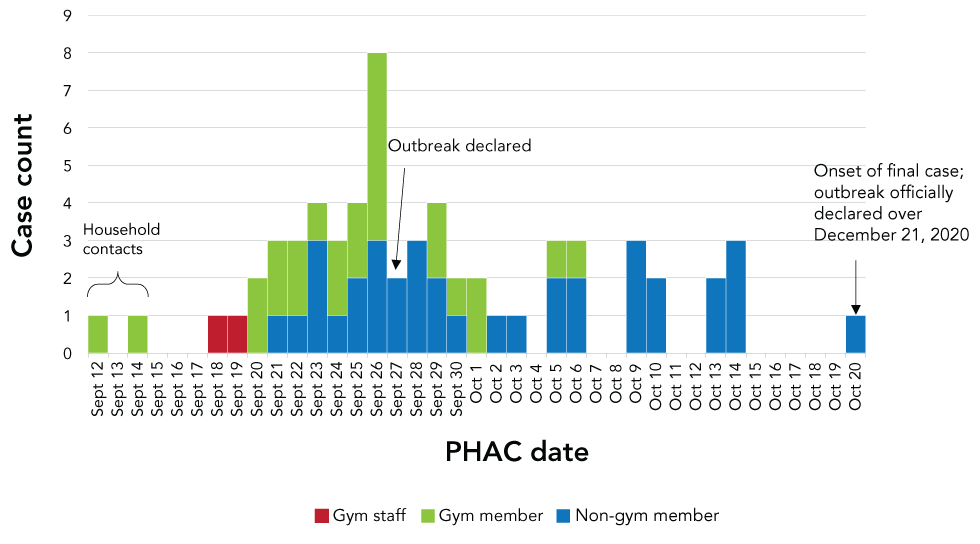

An Outbreak Of Covid 19 Associated With A Fitness Centre In Saskatchewan Lessons For Prevention Ccdr 47 11 Canada Ca

State Corporate Income Tax Rates And Brackets Tax Foundation

Vermont Income Tax Calculator Smartasset

State Income Tax Rates Highest Lowest 2021 Changes

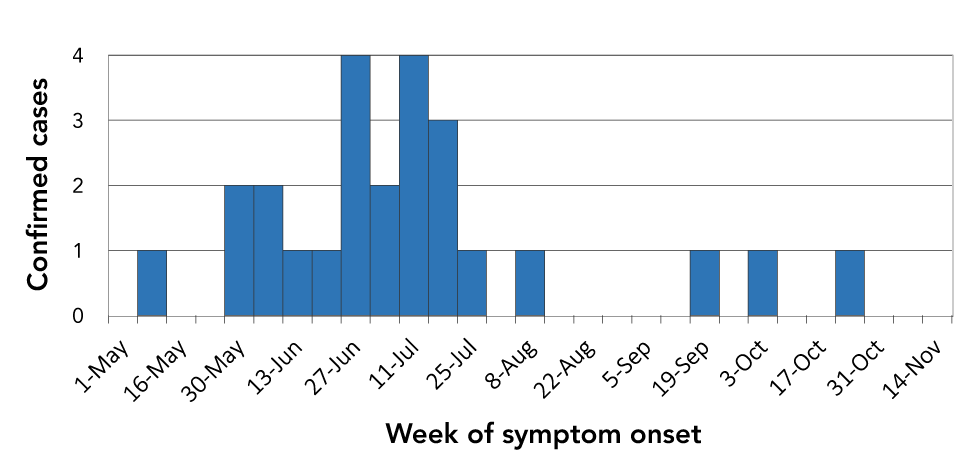

Human Granulocytic Anaplasmosis Discovered In The Estrie Region Of Quebec Canada 2021 Canada Ca